Complaints Agent

97%1 Complaint Identification Accuracy. Autonomously.

Manual tagging catches 65-70% of complaints. The Complaints Agent detects 97%1 — including the ones agents miss, mislabel, or don't recognize as complaints. It then grades severity, analyzes root cause, and generates regulatory-ready reports. All without human review.

Book a Demo

97%1

complaint identification accuracy

70%1

faster complaint reviews

200+

data points extracted per conversation

2 weeks

to go live — not 6 months

Module 01

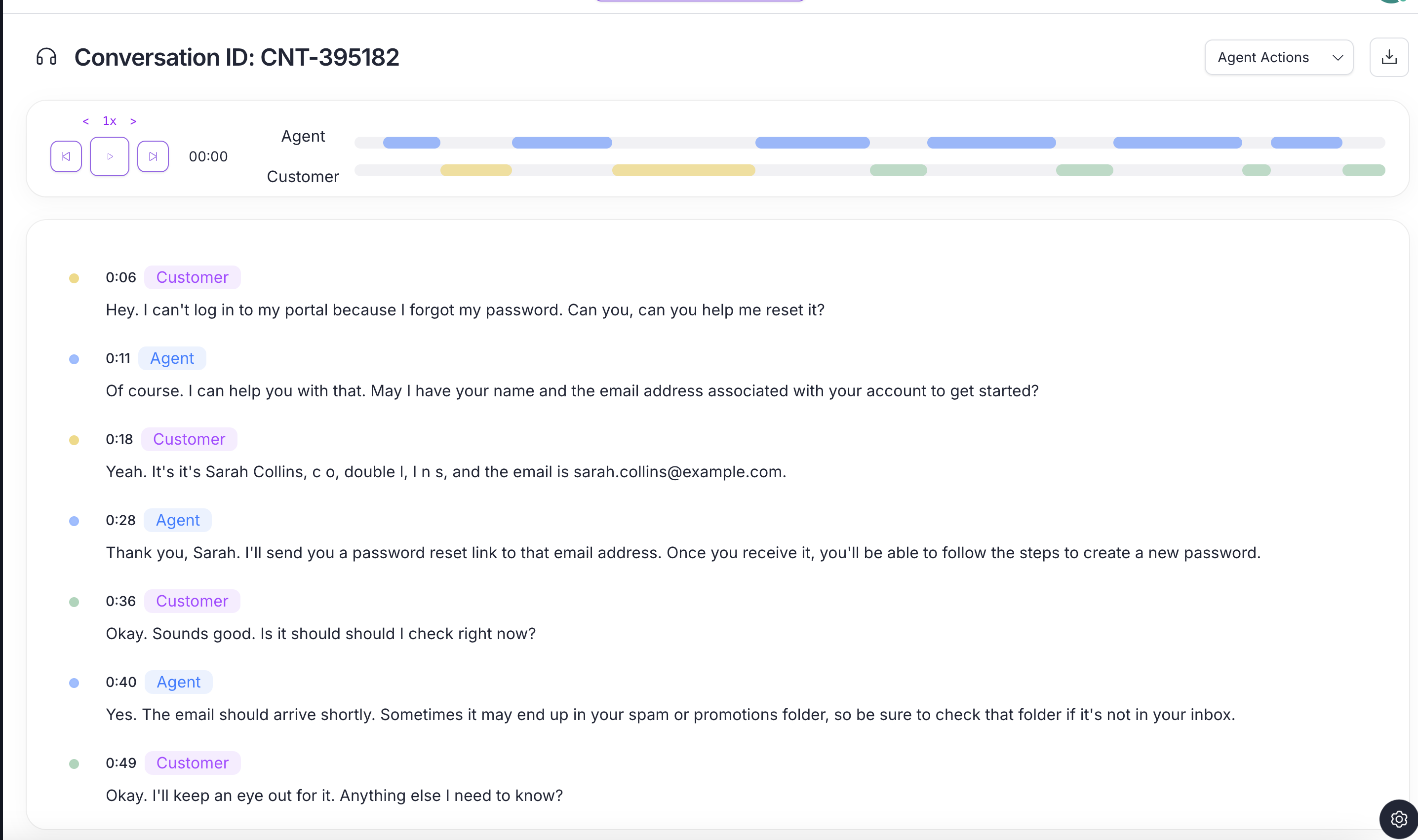

Conversation Intelligence Engine

The foundation of complaint detection. The Complaints Agent processes every call, chat, and email — extracting 200+ structured data points that power downstream detection, analysis, and reporting.

Unified processing for voice, chat, email, and social channels

200+ structured data points extracted per conversation

Custom model tuning to match your complaint definitions — deployed in hours

30%+ more accurate than generic LLMs on financial services conversations1

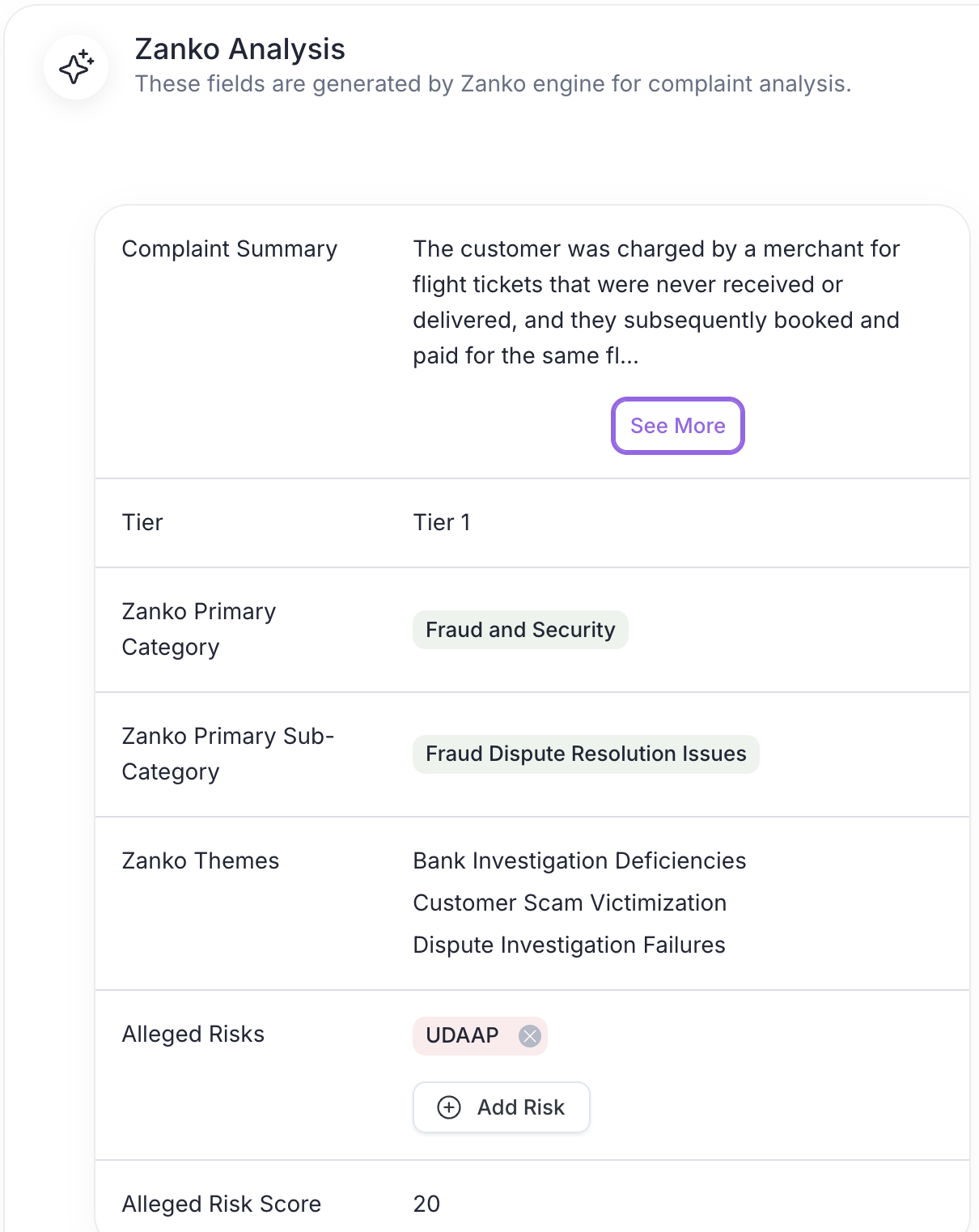

Module 02

Direct Complaints Detection

Not all complaints are obvious. The Complaints Agent detects explicit complaints, expressions of dissatisfaction, and implied grievances — even when customers don't use the word "complaint." Manual tagging catches 65-70%. We catch 97%.

97%1 accuracy on complaint identification — vs. 65-70% for manual tagging

Detects explicit complaints, expressions of dissatisfaction, and implied grievances

Multi-class severity grading: low, medium, high, critical

Root cause classification for trending analysis

97%1

complaint identification accuracy — catching what agents miss

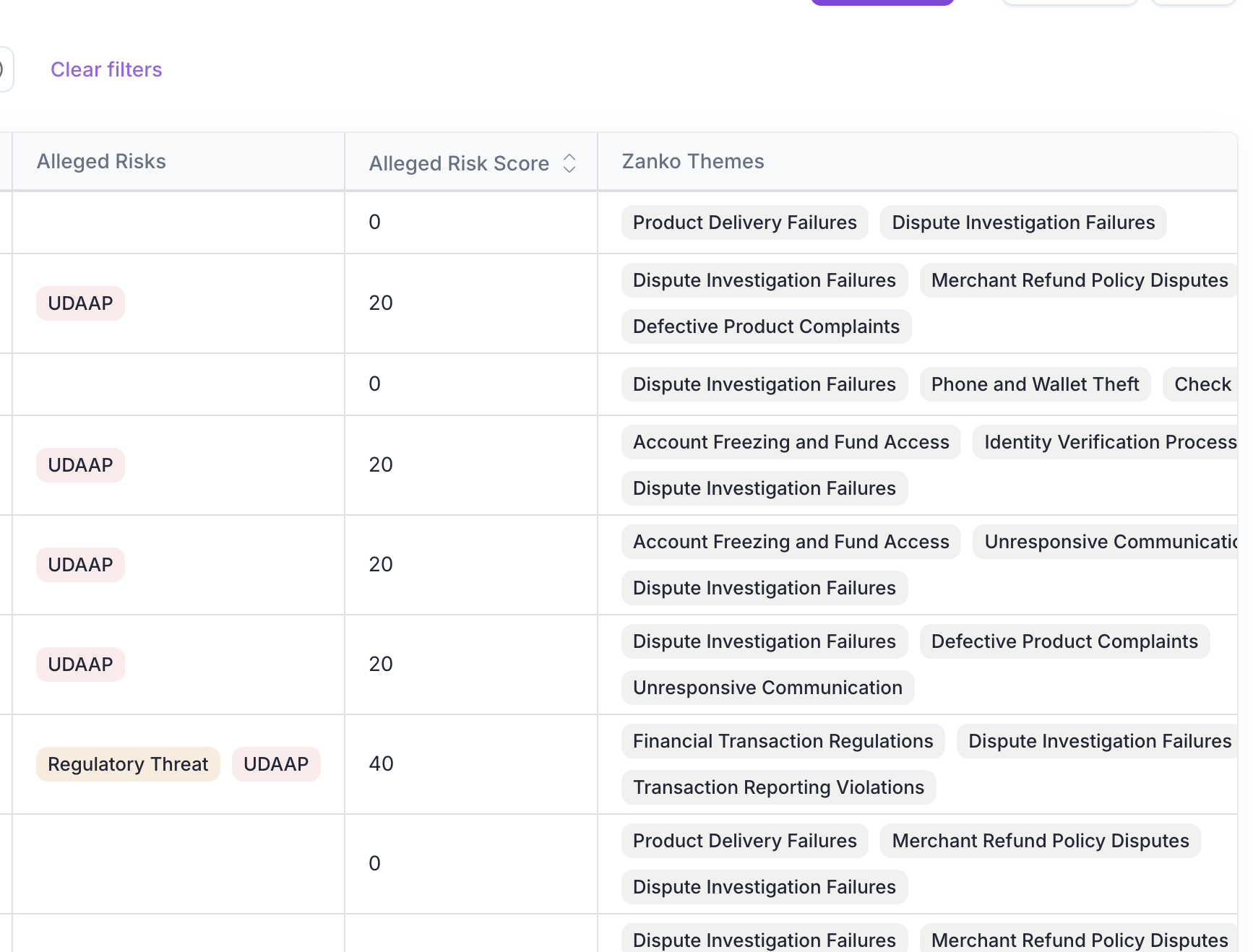

Module 03

Regulatory Complaints Tracking

CFPB escalations, OCC complaints, state regulator inquiries — the Complaints Agent tracks regulatory risk signals and generates compliant logs. For sponsor banks and fintechs, it produces Sponsor Bank-Ready exports that already meets your bank partner's requirements.

CFPB, OCC, and state regulator complaint category mapping

Multi-bank reporting formats for fintechs with multiple sponsor banks

Standardized complaint logs that meet regulatory requirements

Prevention framing: surface risks before regulators do

Module 04

Templated Response Generation

When a complaint is detected, the Complaints Agent doesn't just flag it — it drafts a response. Using your approved templates and tone guidelines, it generates resolution letters, acknowledgment emails, and internal escalation summaries.

AI-generated resolution letters based on complaint type and severity

Acknowledgment email drafts sent within SLA timelines

Customizable templates that match your brand voice and compliance requirements

Human-in-the-loop review option before sending

80%1

reduction in response drafting time with AI-generated templates

Module 05

Resolution Analysis

Complaints aren't resolved until the customer is satisfied. The Complaints Agent tracks resolution status, analyzes resolution effectiveness, and identifies complaints that are at risk of escalation or repeat contact.

Automatic resolution status tracking: pending, in-progress, resolved, escalated

Resolution effectiveness scoring: did the response actually satisfy the customer?

Repeat complaint detection: same customer, same issue, different channel

Escalation risk scoring: which open complaints need urgent attention?

Module 06

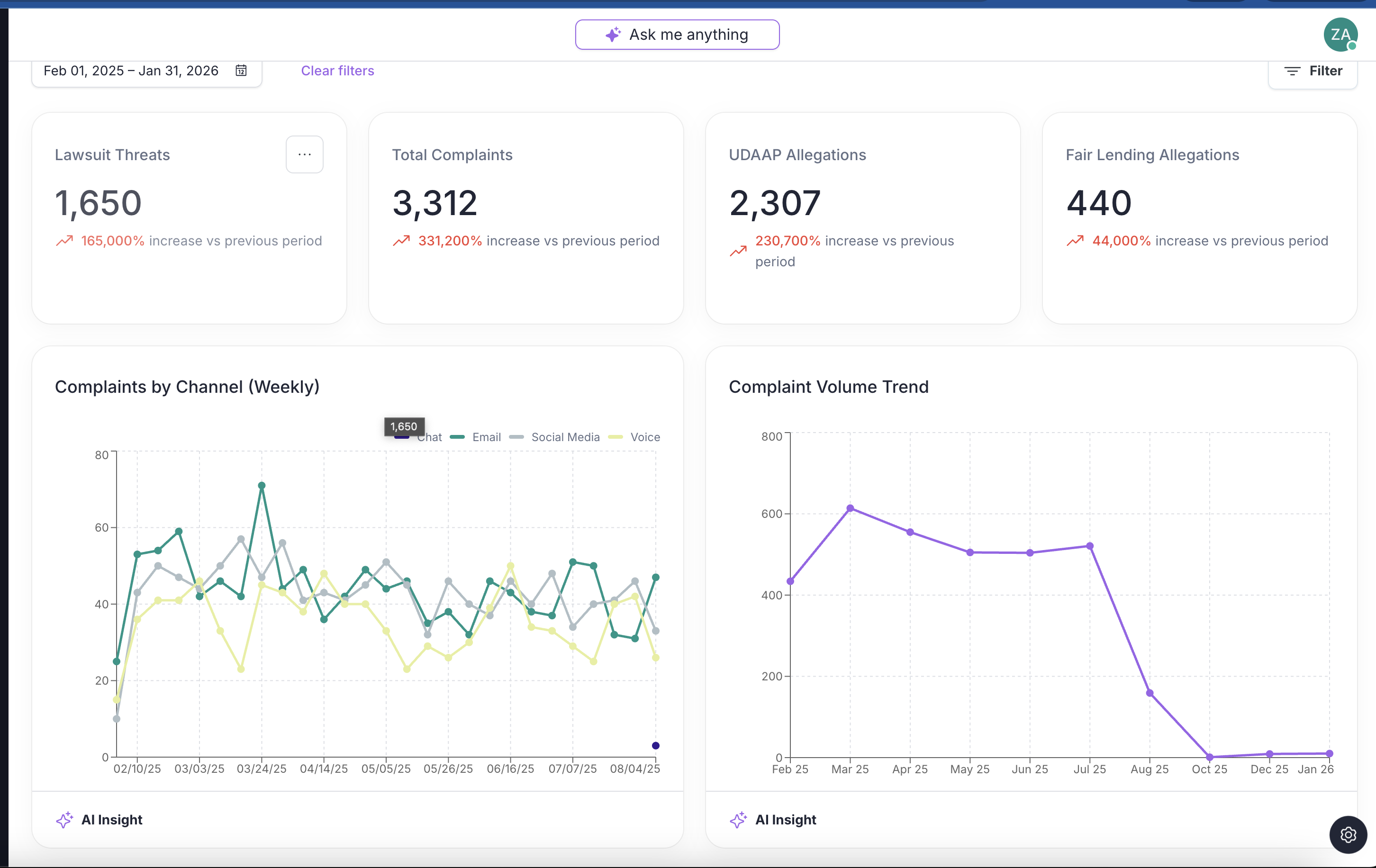

Complaints Insights BI

All complaint data flows into a unified BI dashboard. See complaint volumes, category distributions, resolution rates, root cause trends, and regulatory risk exposure — updated in real-time, not with 30-day lags.

Real-time dashboards vs. 30-45 day reporting lags

Root cause trending: which issues are growing vs. declining?

Product, channel, and agent-level complaint segmentation

Export to Tableau, Power BI, Looker, or use built-in executive reports